Performance Highlights

BENCHMARKS

Disbursement growth

Disbursements expanded at 9%, from `33,195 crores in FY 2017-18 to `36,079 crores in FY 2018-19

AUM growth

Housing credit industry during this period grew at an annualised ~14-16% [Source: ICRA]. AUM (including securitised book) stood at `84,721.9 crores in FY 2018-19, growing 36% over FY 2017-18 annually

Product mix (portfolio on books)

A well-rounded product mix was maintained with 71% attributed to housing loans and 29% to non-housing loans

PAT growth

PAT increased from `841.2 crores in FY 2017-18 to `1,191.5 crores in FY 2018-19, representing a growth of 42%

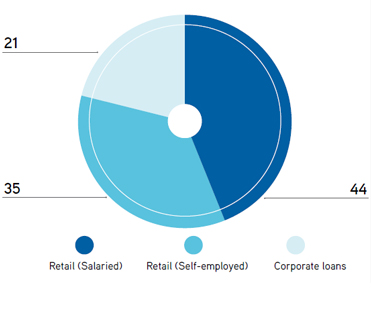

Product mix1៱ (%)

1including securitised book

AUM: Segment-wise share៱(%)

AUM: Product-wise share៱(%)

GEOGRAPHIC DISTRIBUTION

Our portfolio is balanced across western, northern and southern regions.

AUM: Region-wise share^ (%)

^Figures are as on March 31, 2019

*Figures are for FY 2018-19

Disbursement origination* (%)