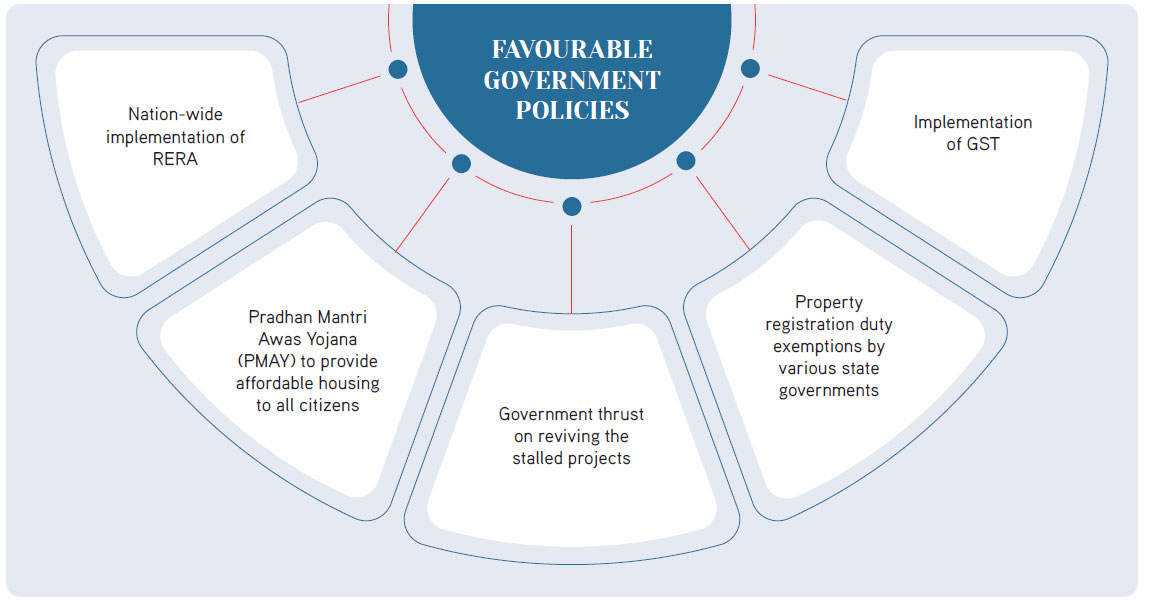

After the initial disruptions caused by the pandemic, the housing sector in the country recovered gradually, driven by lower mortgage rates, favourable sops provided by various state governments and continuous push by the central government towards the affordable housing sector. Despite the new waves of the pandemic, the fundamentals of the sector remain strong.

CHANGES IN BUYING PATTERN

The pandemic has altered the home buying pattern of Indians. Indians are now more aligned to invest in a home, either to live in or leverage as an asset with an additional income generation possibility, that can be used during a period of crisis. Millennials are more comfortable about accessing home loans, and the ease of getting a loan powered by digital tools has provided a fillip to the sector. Additionally, the need for larger space owing to remote working models and reverse migration has pushed demand for homes, especially in Tier II and III cities.

LOWER MORTGAGE PENETRATION

India's mortgage penetration to GDP is one of the lowest in the world at 10.6%. With long-term growth drivers putting real estate growth back on track, the housing finance sector is poised for accelerated growth in the foreseeable future. As per CRISIL, considering the demand prospects, the on-book portfolio of HFCs/NBFCs is expected to grow by 13-15% in FY23.

AFFORDABLE HOUSING, A KEY DEMAND DRIVER

The government has reinforced its commitment to the affordable housing segment by further allocating ` 48,000 crore in Budget 2022-23 to meet the housing deficit in the country. The sector has demonstrated strong growth over the past few years and expects to continue the momentum going forward. Since the announcement of the scheme, close to 98.4 lakh houses have been grounded of the 122.69 lakh sanctioned.

DIGITALISATION AS A GAMECHANGER

Post-pandemic, organisations across the board have accelerated the adoption of digital tools. HFCs are leveraging the power of advanced digital tools to seamlessly onboard customers, providing frictionless journey. Additionally, use of advanced analytics, data sciences, machine learning and artificial intelligence is helping augment underwriting capabilities, resulting in faster TAT. Besides, these tools are also helping the organisation to strengthen credit profiling, collection, recoveries while optimising operating cost.

RESPONDING TO THE OPPORTUNITIES

PNB Housing Finance is cognisant of the external opportunities and is taking the following initiatives to strengthen its position in the Indian housing finance sector.

GOOD TIDINGS