Landing Home Loan

Thank You

Thank you for applying loan with PNB Housing Finance ltd. Our representative will contact you soon. Our business hours are Monday through Saturday, 10:00 a.m. to 6:00 p.m. IST.

Request a Callback

Verify OTP

We have sent an OTP on +91 .

Please enter below.

PNB Housing

Home Loan EMI Calculator

Your EMI is

Interest amount₹ 2,241,811

Total amount payable₹ 4,241,811

PNB Housing

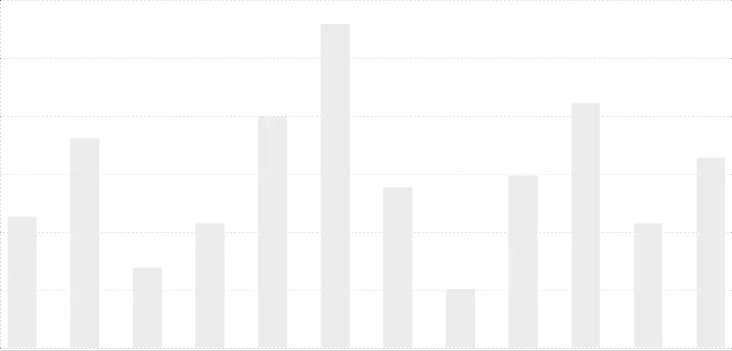

Amortization Chart

Amortization is paying off your loan over time in equal installments. As the term of your home loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term. This chart explains what you pay every year towards principal and interest amount

×

PNB Housing

Amortization Chart

Home Loan

Interest Rate

and non professionals

and non professionals

Home Loan

Documents Required

-

Loan application form (compulsory)

-

Age Proof

-

Residence Proof

-

Income Proof: salary slips of last 3 months

-

Form 16 for last 2 years

-

Latest 6 months bank statement

-

Other Documents such as property title, approved plan.

-

Loan application form (compulsory)

-

Age Proof

-

Residence Proof

-

Income Proof for business and ITR

-

Proof of business existence

-

Last 3 years income tax returns

-

Accountant-certified balance sheets last 12 months bank account statement

-

Other Documents such as property title, approved plan, etc.

Home Loan

Frequently Asked Questions

You are eligible for a loan if you are a salaried, self- employed professional or a businessman. Your loan eligibility will be determined by PNBHFL on the basis of factors such as income, age, qualifications, number of dependants, co-applicants income, assets, liabilities, stability and continuity of occupation and savings history. Further, the loan eligibility will also be dependent on the value of property selected by you.

We can fund upto 90%* of the property value in case of Home Loan and upto 70%* in case of Loan Against Property. However, PNBHFL funding norms may change as per the company norms.

Your loan is repaid through Equated Monthly Installments, which include principal and interest component. EMI repayment starts from the subsequent month of full loan disbursement, while Pre-EMI is the simple interest, payable every month till the time loan is fully disbursed.

Keeping the borrowers interest in consideration, EMI is kept unchanged till a point. In exceptional situations, the EMI is changed to support the principal repayment within a time frame.

The prime security for the loan is by way of deposit of title deeds and/or such other collateral security as may be necessary. The title of the property should be clear, marketable and free from any encumbrances.

Yes, you can prepay your Home Loan any time during the loan tenure. Currently it is free from any charges; however prepayment norms may change from time to time.

*Disclaimer: The information provided in these FAQs is for general guidance only and may vary based on PNB Housing's current policies, terms, and conditions. loan eligibility, interest rates, tenure, and other factors are subject to change based on the prevailing company policy and regulatory guidelines at the time of application. For the most accurate and personalised information, we encourage you to consult directly with a PNB Housing loan specialist.

- a. As regards deposit taking activity of the Company, the viewers may refer to the advertisement in the newspaper/ information furnished in the application form for soliciting public deposits.

- b. The Company is having a valid Certificate of Registration dated 31.07.2001 issued under Section 29A of the National Housing Bank Act, 1987. However, the Reserve Bank of India or the National Housing Bank does not accept any responsibility or guarantee about the present position as to the financial soundness of the Company or for the correctness of any of the statements or representations made or opinions expressed by the company and for repayment of deposits/ discharge of the liabilities by the Company.

- c. Terms and conditions apply. All loans are at the discretion of the Company. Other fees and charges are applicable. For further details, refer website of the Company, www.pnbhousing.com | CIN: L65922DL1988PLC033856.