Governance

Upholding the highest standards

At PNB Housing Finance, we prioritise robust governance to ensure transparency, accountability and integrity across our operations. Our governance framework is designed to protect stakeholder interests, promote ethical practices and drive sustainable growth. Committed to the highest standards of corporate governance, we continuously strive to enhance our governance policies, ensuring compliance and fostering trust among our stakeholders.

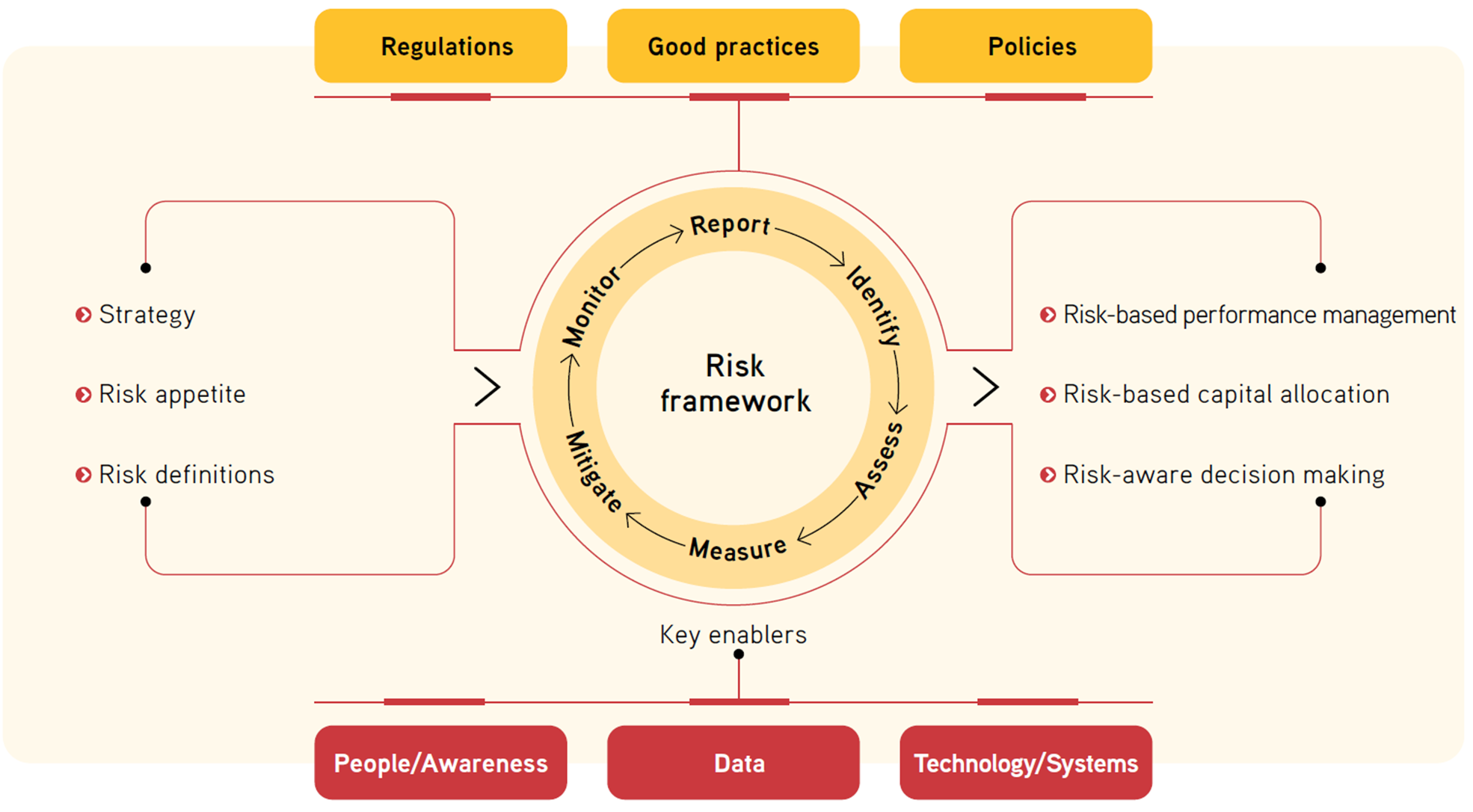

Robust risk management framework

The Risk Management Committee (RMC) of the Board oversees our risk management practices and approves the Risk Management Framework. The Executive RMC, comprising senior members, regularly reviews this framework to ensure its effectiveness. Each business unit is accountable for the effective management of risks within their respective areas. Additionally, the Internal Audit function independently assesses the internal controls and the Risk Management Framework, ensuring their robustness. The Statutory and Compliance function also operates independently to monitor regulatory compliances, ensuring that all operations adhere to legal and regulatory standards. Together, these layers of oversight and accountability foster a resilient and well-governed risk management culture within the Company.

60 years

Average age of

Board members

33 years

Average experience of

Board members

4.3 years

Average tenure in

the Company

BOARD COMPOSITION AND COMMITTEES OF THE BOARD

- Audit Committee

- Risk Management Committee

- Credit Committee

- Nomination and Remuneration Committee

- Stakeholders Relationship Committee

- Corporate Social Responsibility Committee

- IT Strategy Committee

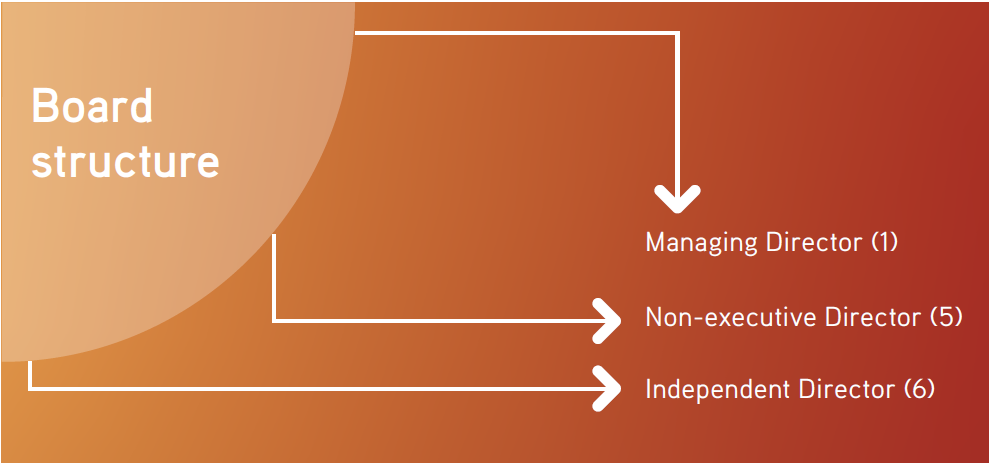

Led by a strong Board of Directors

Our Board provides valuable leadership and guidance to the Company, with directors possessing extensive knowledge of the industry and operations. Operating in the financial sector and dealing with mortgages, the Board understands various financial lifecycles, key challenges, competition and have experiences with credit cycles, workouts, and remedial management. Our Board members bring vast experience in the financial sector, economics, mortgages, banking, investment & wealth management, governance, international operations, fintech regulation, currency management, risk management, credit, and information technology. Highly qualified, they have held leadership positions in high-performing organisations, equipping them to guide the Company towards growth and excellence in the mortgage industry.

Board’s responsibilities

The Board oversees the Company’s long-term strategic planning and direction, maximising shareholders’ value and protecting all stakeholders’ interests. It provides strategic guidance to management and operates through various Committees with specific roles and responsibilities. These Committees closely monitor the Company’s performance, and the Board reviews overall performance regularly. The Board has a formal schedule for considering and deciding on significant matters and those mandatorily required.

Ethical conduct

Our Board adheres to a comprehensive Code of Conduct for all Non-Executive Directors, including Independent Directors, in line with regulatory requirements. This code emphasises professional conduct, ethics, and governance. We also have distinct Codes of Conduct for Executive Directors and Senior Management. To foster an ethical culture, we implement various policies and frameworks on corporate governance, insider trading prohibition, related-party transactions, sexual harassment prevention, CSR, fair practices etc. These policies are consistently communicated to management, employees, and stakeholders.

Regulatory compliances

We comply with RBI directions and guidelines, including those on deposit acceptance, accounting standards, asset classification, income recognition, provisioning, capital adequacy, credit rating, corporate governance, IT framework, fraud monitoring, investment concentration, capital market exposure, Liquidity Coverage Ratio (LCR), loan transfers, KYC & AML guidelines, etc.

Additional policies

In compliance with the regulations and guidelines issued by regulatory authorities like Reserve Bank of India, National Housing Bank, Securities Exchange Board of India, Insurance Regulatory Development Authority of India, Ministry of Corporate Affairs, etc. and other applicable laws, and as part of our commitment to good corporate governance and robust internal controls, the Board adopted various policies and the same are reviewed periodically. We have established a comprehensive Whistle-blower Policy that empowers employees to report any serious irregularities or violations within the organisation. This policy provides direct access to the Chairperson of the Audit Committee, ensuring transparency and accountability. Additionally, we have implemented a robust grievance redressal mechanism for our customers for addressing their concerns promptly. Shareholders’ grievances are diligently handled through dedicated email addresses and actively monitored by our Secretarial team and Investor Relations Team. Our Boardapproved policies cover succession planning, outsourcing, anti-corruption and anti-bribery, information security, and cyber crisis management etc, ensuring adherence to statutory requirements.

Anti-money laundering

We have a robust Know Your Customer (KYC) and Anti-Money Laundering (AML) policy, aligned with the Reserve Bank of India’s (RBI) guidelines and the Prevention of Money Laundering Act. Approved by the Board, this policy includes essential elements such as Customer Acceptance Policy, Customer Identification Procedures, and Risk Management and Transaction Monitoring. We diligently ensure compliance with these guidelines throughout the customer lifecycle. Additionally, we have developed a targeted training module to provide effective and focused training on anti-corruption and AML practices.

In line with RBI’s directives for driving anti-money laundering initiatives, NBFCs, including HFCs, are advised to follow specific customer identification procedures to monitor and report suspicious transactions. Accordingly, the Company conducts periodic money laundering and terrorist financing risk assessments to identify, evaluate, and implement effective measures to mitigate these risks.

Diversity in the Board

Our Board comprises individuals with diverse expertise, academic backgrounds, and industry experience, promoting diversity and inclusivity. Our Board Diversity policy underscores our belief in inclusivity as a key driver of performance and success. The Company recognises and embraces the significance of a diverse Board, believing that it enhances the quality of decisions by leveraging the varied skills, qualifications, professional experiences, backgrounds, gender, ethnicity, knowledge, length of service, and other distinguished qualities of its members. This diversity is essential for driving business results, achieving competitive advantage, ensuring effective corporate governance, and promoting sustainable and balanced development.